2023 Dirty Dozen: Ineligible Employee Retention Credit Claims

Identity theft usually takes center stage during most tax-scam discussions. After all, so much of our personal and professional lives take place onlin

Identity theft usually takes center stage during most tax-scam discussions. After all, so much of our personal and professional lives take place onlin

New technology could improve tax return processing time at the IRS

Paper returns have historically been slower to process due to the Internal Revenue

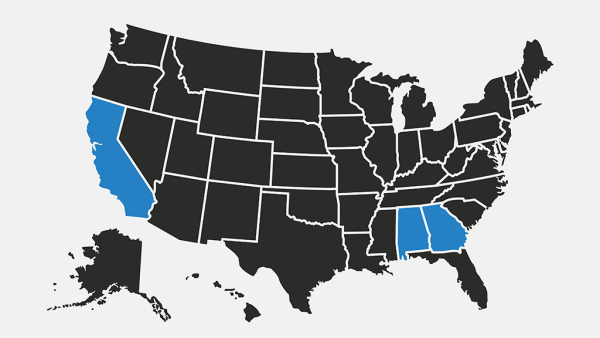

The Internal Revenue Service recently extended tax relief for disaster victims in Alabama, California, and Georgia. Individuals and businesses in thes

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the

Filing an amended return used to mean completing a paper form, regardless of how taxpayers submitted the original return to the Internal Revenue Servi

In 2022, millions of Americans received special state-issued payments designed to provide economic relief to residents struggling with financial burde